Award-winning PDF software

Hawaii Form 886-H-DEP: What You Should Know

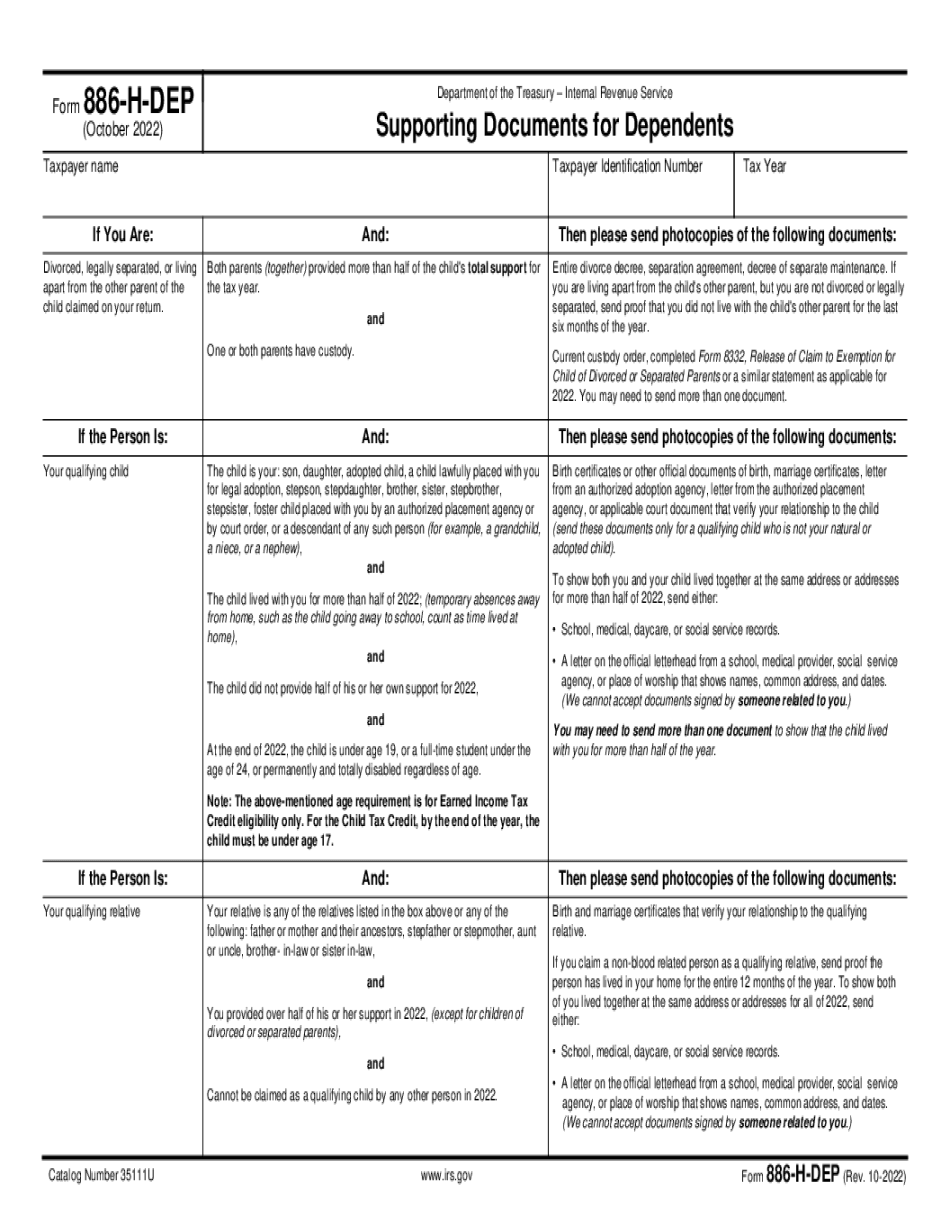

A copy of the application and proof of support. (We cannot give you your documents. You must give your application and proof of support. We do give you the IRS Form 942 and the non-refundable credits for the 2025 tax year.) If the child was born before June 1, 2011, and your Form 8801-MPR (Spanish Version) — IRS If you were married, or you lived in a common-law relationship (and you did not obtain a court order terminating your prior marriage), we can't give you your Form 8801-EIC (Spanish Version) — IRS document. You must give us a complete copy from the official court documents. You can get complete copies here or ask to call for copies of court papers. For more information on court documents, visit the National Council on Family Relations. It helps us to have the following documents: Proof of support—pay stubs, tax returns, credit reports, or credit card statements A court order for support If the child has no mother or father, it helps us to have the following documents: An adoption decision A birth certificate A certified copy of your name change document (if you have one on file) We prefer to have the following documents, only if they demonstrate that your previous support was not made before the child became emancipated: Pay stubs for the past two years, and a copy of a court order to show that your ex-spouse/former husband/divorced/widowed is no longer the mayor (or to show that you changed the payer or the address to which the money was paid) You must provide us with the following documents: Social Security cards, bank accounts, or employment records (including copies of tax returns) Your wages and job history. To find this information, go to the Social Security Administration website and use Social Security search tool at the top. If the information is missing, we'll need the original. We are working to develop a way for you to submit additional income information to help verify a child's or spouse's income. You must provide us with a completed Form 886-H (or 886-W) (Form 886-H‑DEP), including support information requested above. You can submit your application along with copies of your supporting documentation. This form also includes additional information about support.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Hawaii Form 886-H-DEP, keep away from glitches and furnish it inside a timely method:

How to complete a Hawaii Form 886-H-DEP?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Hawaii Form 886-H-DEP aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Hawaii Form 886-H-DEP from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.