Award-winning PDF software

Los Angeles California Form 886-H-DEP: What You Should Know

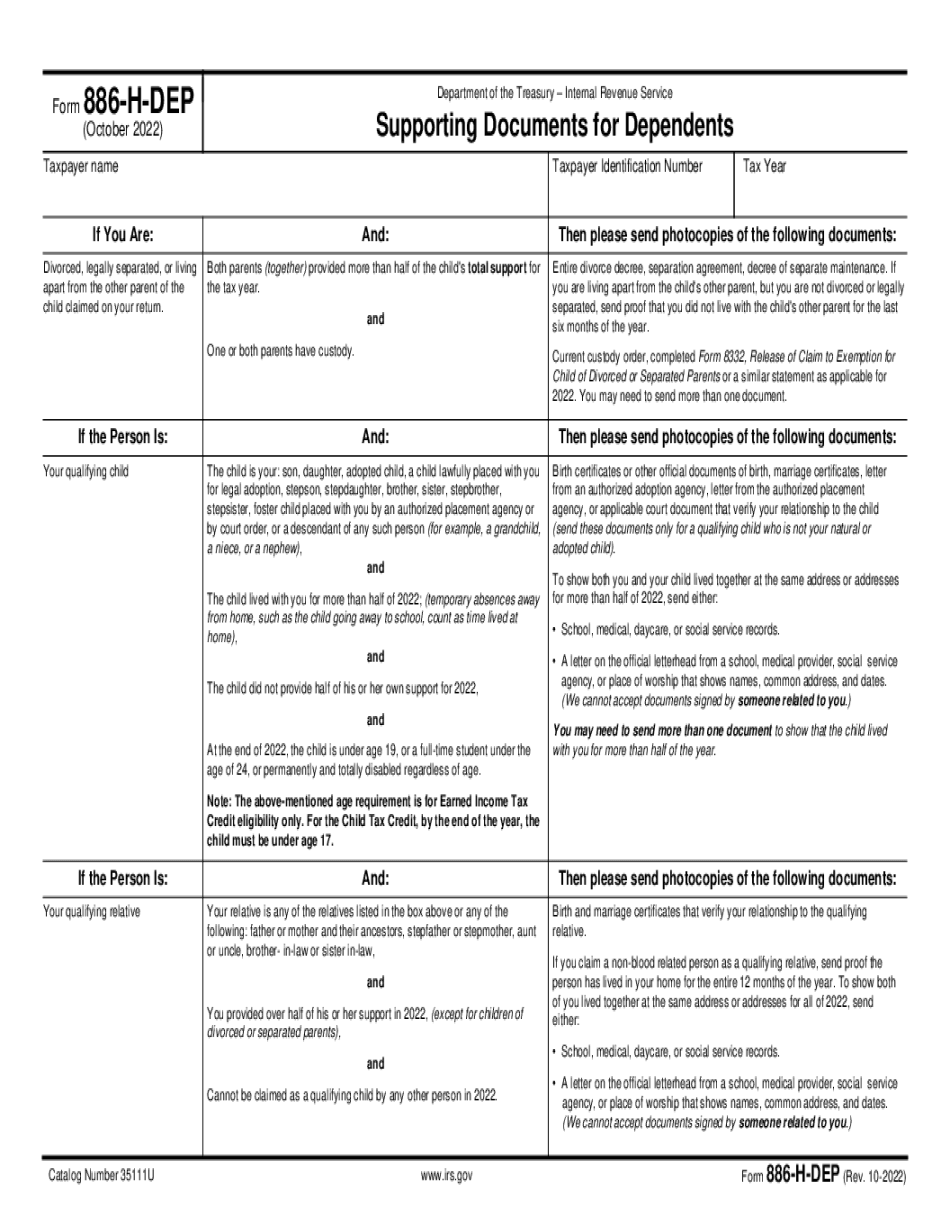

This is a tax from the IRS developed to help support the filing of a petition to the court for a support obligation exemption for child in the following relationship. For example, this may be applied to: A) Divorced Parents and B) Separation of Child(men, children from opposite or opposite parents in same or different homes) This is not a simple test, it requires you to know if: You are: The sole caregiver for the child If either spouse filed for a support obligation exemption for the other for a child The child was ever adopted by a stepparent. You must complete and attach all the documents listed in Schedule C. Schedule C and the supporting documentation you are required to provide must: be based on the information provided, not on hearsay or any other “inference”, If you have a joint return, you will have to submit a joint tax return, if you are filing in person. The other party should fill out and attach a Form 886-H for Parent or Parent of Child, including an individual or joint return. If the other parties' return does not provide you a child support figure, you will also need to file a Form 866-H for a child support figure based on information that was not included in the other person's return. If you are a non-resident alien, you must provide the documentation listed below: The child was not ever adopted by a step-parent The child was adopted by a stepparent. You have not been employed full-time by the other parent for at least three years prior to filing the Form 886-H. The job the other parent holds is the sole or main job of the child and: The parent's only other job of the child is part-time or casual. The child lives more than half-time with the parent. If this number is a combination of one and three that is less than five the number must be at least five. The employment is at a retail store, restaurant, home health agency or public library and: The parent's primary job is the store, restaurant or library. The spouse's sole job of the child is in another retail store, restaurant, home health agency or public library. You have a joint return with neither parent in active military service nor you have a divorce or separation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Los Angeles California Form 886-H-DEP, keep away from glitches and furnish it inside a timely method:

How to complete a Los Angeles California Form 886-H-DEP?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Los Angeles California Form 886-H-DEP aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Los Angeles California Form 886-H-DEP from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.