Award-winning PDF software

Form 886-H-DEP Florida Hillsborough: What You Should Know

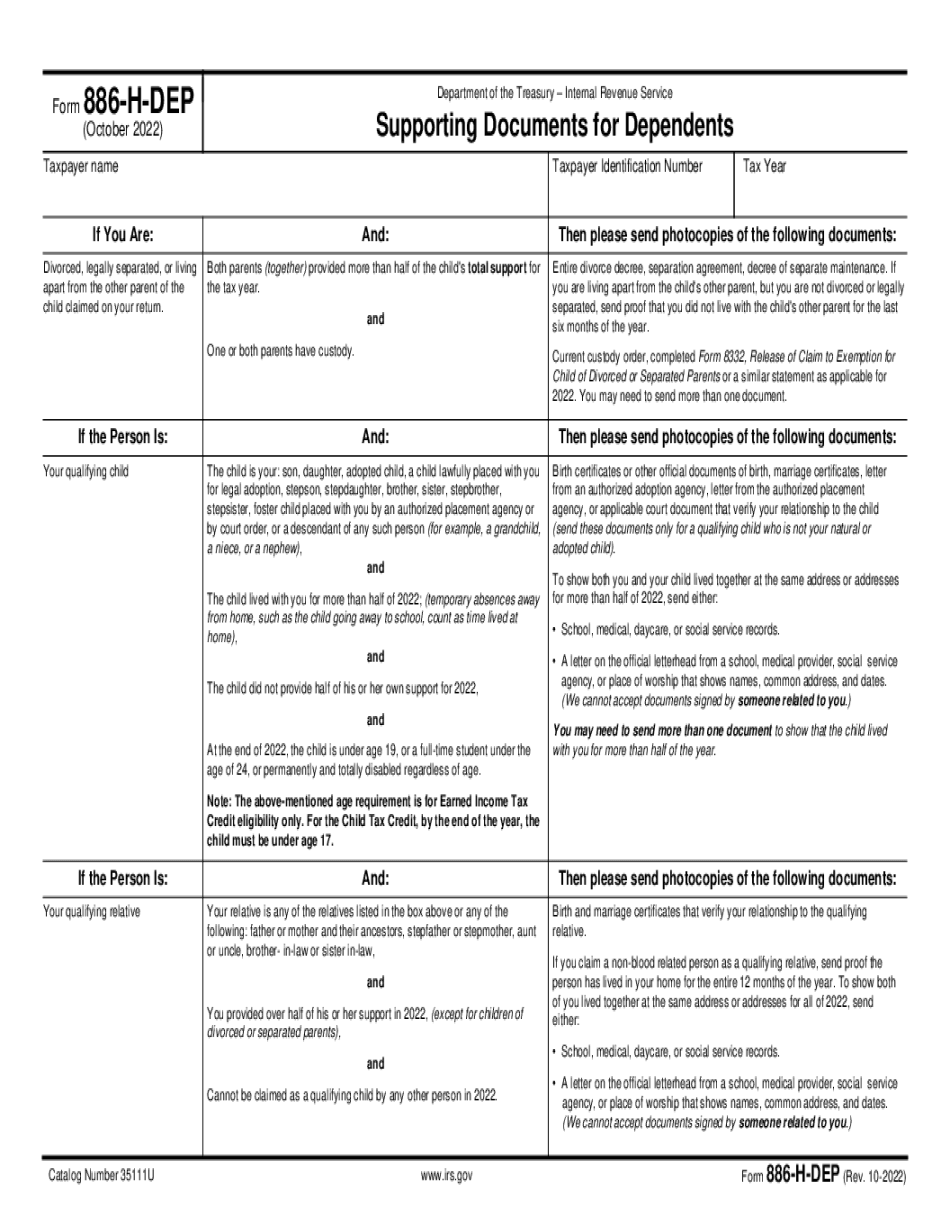

The following statement in the case description should address those cases requiring an application to Exemption. This can be a form 886 or a similar document, but must include the following statement: “Pursuant to [the] Internal Revenue Code, Title 26, Section 151, Exemption is available to a dependent of a child of a nonresident alien who receives a tax benefit for his or her income, whether in the form of cash, income from a business or other source, or any combination thereof. A dependent of a nonresident or U.S. citizen who is receiving assistance from a government, governmental unit, or agency may also be eligible for this exemption.” (The “Supporting Documents” section has a link to the forms). There are a couple of reasons to go ahead and submit an Exemption Application Form. First, if you know you will be applying for it yourself before it comes to the taxpayer's notice of deficiency date, the form should take you some extra time to review. Also, as an Exemption Application the date can end up being the next tax day, a weekend or a holiday you may be out of town. However, if you already submitted your Form 886 last year, it should show you as a “Current Custody Exempt From Federal Return”, so it is good to have this in front of you. A check mark, (x) means the Exemption Application was successfully submitted. For those cases where the taxpayer has already submitted the Form 886/88A, but has not filed the Exemption Application yet, you will need to apply for a refund with the IRS. If you don't have the Form 886/88A, you can start the claim, which will put you through the filing process in order to get the refund. Form 886-H-DEP. (October 8, 2019). Department of the Treasury–Internal Revenue Service, Supporting Documents for Dependency Exemptions. Taxpayer name.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 886-H-DEP Florida Hillsborough, keep away from glitches and furnish it inside a timely method:

How to complete a Form 886-H-DEP Florida Hillsborough?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 886-H-DEP Florida Hillsborough aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 886-H-DEP Florida Hillsborough from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.