Award-winning PDF software

Huntsville Alabama online Form 886-H-DEP: What You Should Know

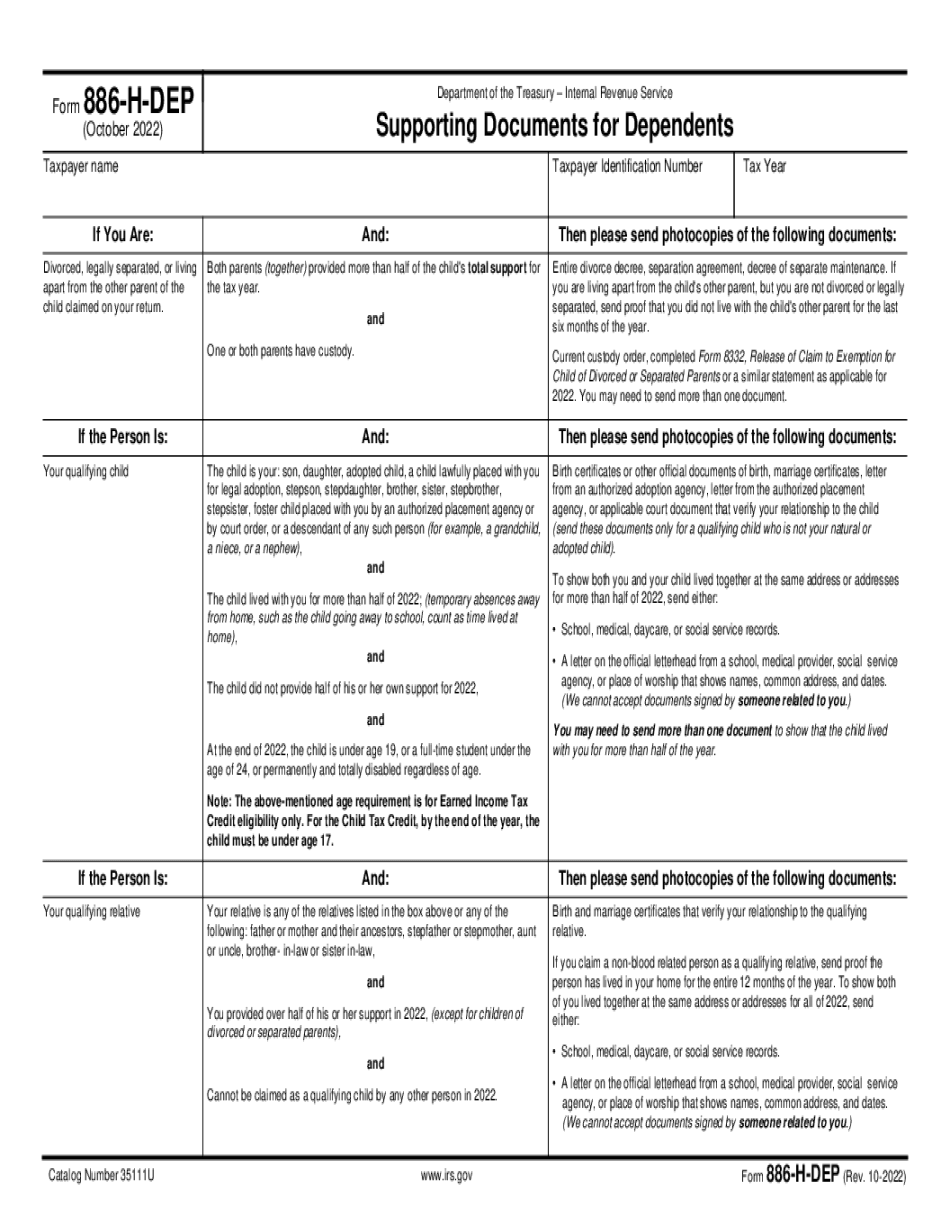

Date of birth. Social Security Number. Alabama residential address. Social security number or taxpayer identification number. Last Four Social Security Numbers (last 4 digits of the SSN) as applicable. (If you received a social security number on a birth certificate and have it in your child's birth certificate, write it in the child's name). Parent's names and contact information (street address, zip code, and phone number). If you do not have a social security number, the child is considered to be dependent upon you for U.S. income tax purposes if the parent does not earn 2,000 a year or less. You are required to list your child for the child tax credit if it is an individual who is not otherwise included on your tax return. See my page here for more information about dependent exemptions and the dependent child tax credit on Form 886-H-DEP (10-2021) This form was prepared and distributed by the Alabama Department of Revenue in cooperation with the Internal Revenue Service. The Alabama Department of Revenue did not review or approve these forms. If you need help completing or reviewing this form, contact the Alabama Division of Taxation. The Department of Human Resources is the agency which receives the information which the department submits to the Alabama Department of Revenue that form 886-H-DEP. It is on this form that the department tells the IRS if any change needs to be made in this section, as they have to do every year to the Form 886-EZ Form 870-EZ as well for each state under its jurisdiction. The Department of Human Resources gives the IRS the necessary information to prepare the Form 886-EZ. After the Form 886-EZ is completed, the IRS must determine if these states and their dependent children are subject to the Medicaid expansion. It is on this form that the IRS determines the Medicaid enrollment for the current federal budget year on or after December 31st, 2025 and the tax law requires that all states and their dependent children are enrolled in Medicaid by that time, so they are eligible for the Medicaid expansion. _________ Alabama Department of Human Resources Alabama Department of Human Resources and Substance Abuse and Mental Health Services Administration, Division of Child and Family Services Department, Alabama, Office of the Attorney General Child and Family Services Division 1201 Peach tree St.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Huntsville Alabama online Form 886-H-DEP, keep away from glitches and furnish it inside a timely method:

How to complete a Huntsville Alabama online Form 886-H-DEP?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Huntsville Alabama online Form 886-H-DEP aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Huntsville Alabama online Form 886-H-DEP from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.