Award-winning PDF software

Form 886-H-DEP Arlington Texas: What You Should Know

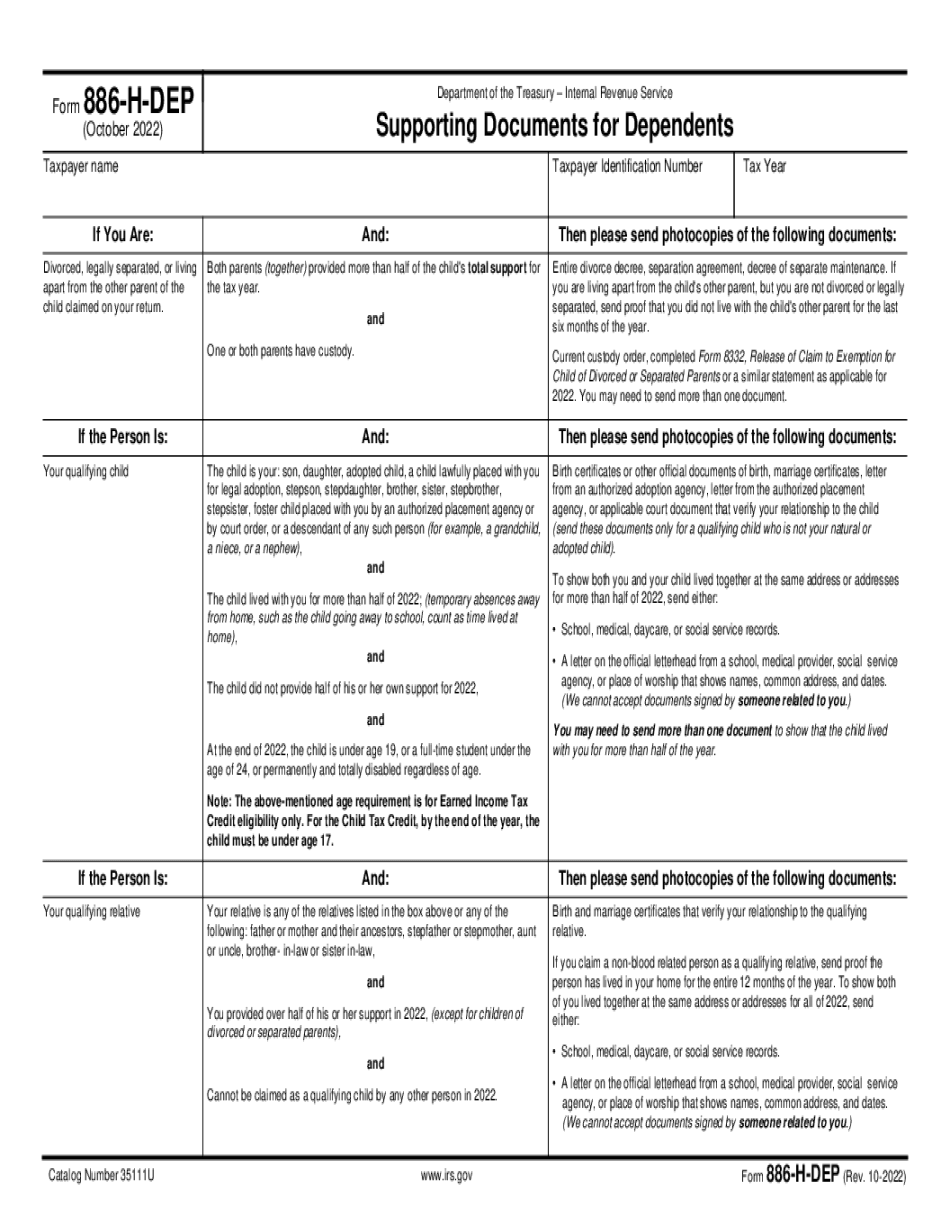

This is how to claim your child as a dependent. There will be a check off for yourself, your spouse, each member of your household, or the Social Security of your child! And there's more to this form than you might ever know! A little about our family. My father was raised by his grandparents and was adopted as a toddler as a “cousin” by his mother. His birth mother was born to a woman who had been a prostitute. My mother was a stripper, prostitute, and meth addict (the mother of the prostitute was my grandmother who never married my father!!) . My father's father was a man who was a convicted felon and then was in and out of prison until he became a minister. His father was killed by someone who used to work with my mother. As a child, my father was often sent to my mother's house so that the abuser had the opportunity to abuse my father. I'm currently married to my husband, and we love each other very much. This is the story of my father and his mother at a young age. What the IRS says “The IRS uses the terms 'parent' and 'child' to refer to a person (including an adoptive parent) who adopted a person (including an adoptive child) out of a legally recognized relationship as a child of the biological mother and/or the biological father, regardless of the legal relationship between them, whether legal or not.” Note also, “If you believe you were not properly adopted, there is a claim for tax relief under § 6101(a).” What can you do? I would recommend that you work with a local attorney to go through this form thoroughly and get an accurate picture of your situation. If you live in a city, you can use this form to see what your rights and responsibilities are as a parent. We do not know how many children are left to us by abusive parents. But I would not be surprised to find out that not enough. I would be interested in hearing about your experiences with your parents and the effect your parents have had on your life. Now, before I close, there is one more interesting note about this form. This form (Form 886-H-826(R)) can actually affect your future taxes if you were born in 2025 or later.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 886-H-DEP Arlington Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 886-H-DEP Arlington Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 886-H-DEP Arlington Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 886-H-DEP Arlington Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.