Award-winning PDF software

Form 886-H-Hoh (Rev 10-2015): What You Should Know

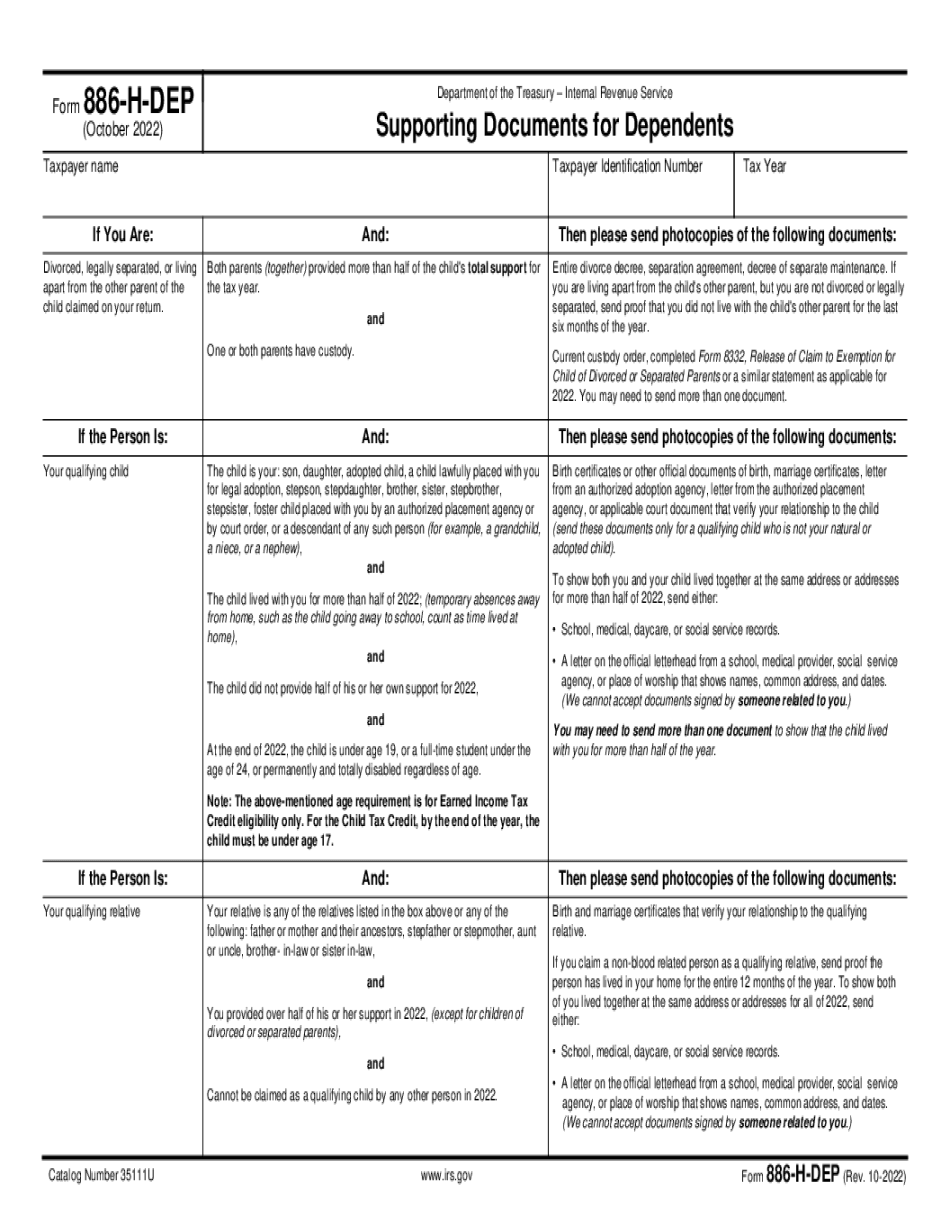

March 9, 2025 — Form 14815 PDF, Supporting Documents for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) for 2; form 886-H-ITIN Form 886-H-ITIN (Rev. 10-2019) — IRS Form 886-H-ITIN (Rev. 10-2019). Catalog Number 35871 (September 2019). Department of the Treasury–Internal Revenue Service. March 9, 2021, Form 14815 PDF, Supporting Documents for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) for 2025 ; Form 886-H-ITIN Form 886-H-ITIN (Rev. 10-2019) — RTA Form 886-H-ITIN (Rev.

Online choices help you to arrange your doc management and supercharge the productivity of your respective workflow. Stick to the short guide with the intention to entire Form 886-H-HOH (Rev 10-2015), prevent errors and furnish it in the well timed method:

How to finish a Form 886-H-HOH (Rev 10-2015) on-line:

- On the web site using the type, simply click Initiate Now and move on the editor.

- Use the clues to complete the relevant fields.

- Include your own data and speak to facts.

- Make absolutely sure which you enter accurate data and figures in best suited fields.

- Carefully verify the subject matter on the form too as grammar and spelling.

- Refer that will help portion in case you have any thoughts or tackle our Support group.

- Put an electronic signature on the Form 886-H-HOH (Rev 10-2015) using the support of Indicator Resource.

- Once the shape is completed, push Executed.

- Distribute the all set form by means of email or fax, print it out or help you save on your device.

PDF editor allows for you to definitely make improvements to your Form 886-H-HOH (Rev 10-2015) from any world wide web linked device, personalize it in line with your requirements, signal it electronically and distribute in various tactics.