Award-winning PDF software

Form 886-H-Itin (Rev 6-2017) - Internal Revenue Service: What You Should Know

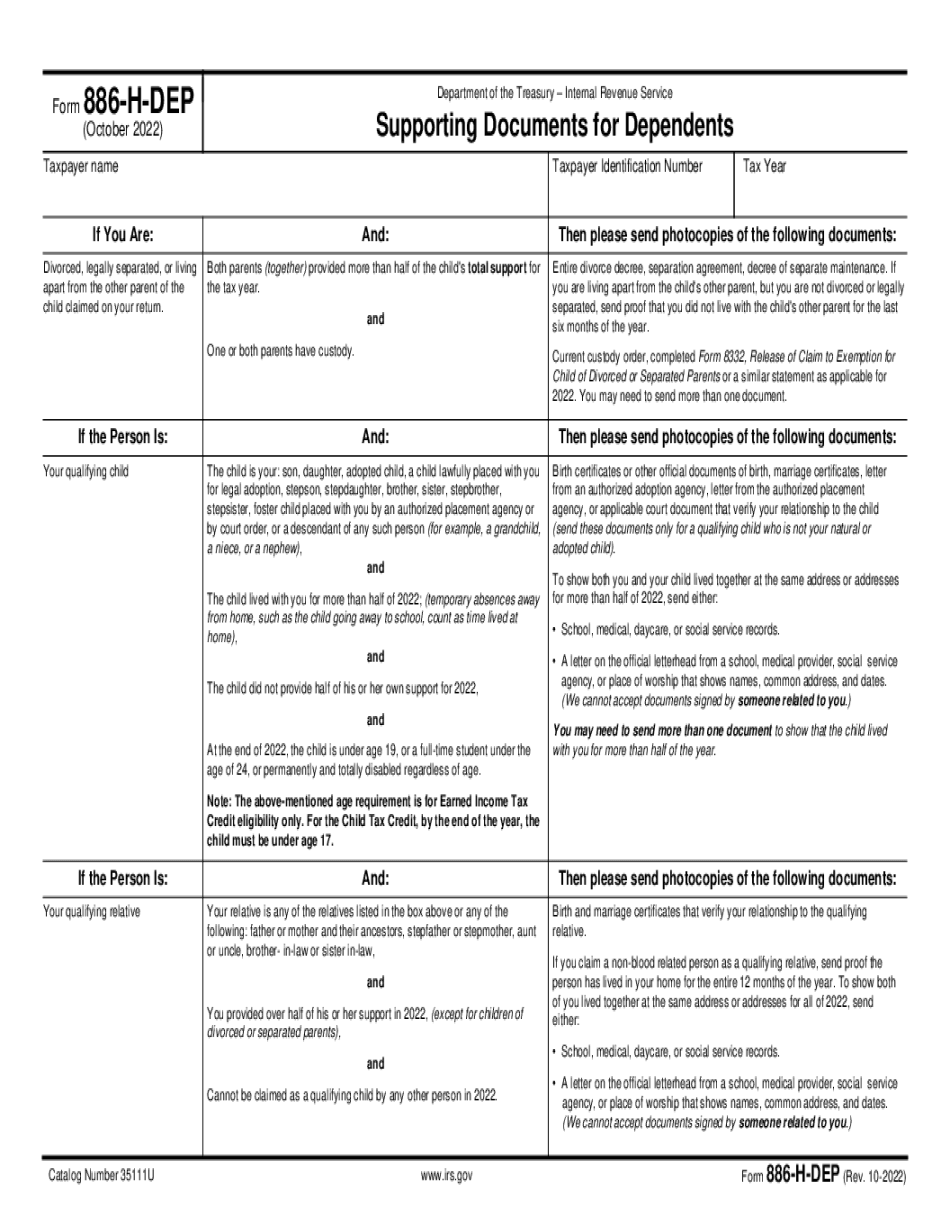

You must be listed in this documentation. Form 886-H-ITIN (Rev 6-2017). Catalog Number 61951L. You should include your personal information, including any information you have provided for information about the foster child such as birthdate, physical description, foster care history, and placement or adoption. Your Social Security number, your driver's license number, and proof of income are required. The forms you used are still valid and should be used by others to apply for the ETC. Form 707: Family & Medical Leave Act (FMLA) Mar 16, 2025 — You are a qualifying employee listed in our Employer Responsibilities section. If you wish, you can apply to your local government for an ETC to supplement the wages of your employees who meet the requirements. For more information click here. Our records indicate that you must include your Social Security Number, Driver's License Number, and proof of your home state income. This form is used to claim the credit on social security tax, and the credit is not allowed to be claimed by a dependent. Foster Tax Credit: (Rev. 2, 2/15/18) Mar 10, 2025 — You are a qualifying employee listed in our Employer Responsibilities section. If you wish, you can apply to your local government for an ETC to supplement the wages of your employees who meet the requirements. For more information click here. Our records indicate that you must include your Social Security Number, Driver's License Number, and proof of your home state income. What to send us — Documents such as a passport, visa, rental property lease showing the child as an occupant, records for school or child care enrollment and Form 886-H-ITIN Dependant-Related Tax Benefits and Credits Form 886-P (Rev. 7-2017) — IRS Your foster child placed with you by an authorized placement agency. A statement on the letterhead of the authorized placement agency or the court document to the child's attorney indicates that the placement agency or the court representation represents the placement agency or court of the home court when considering placement with you.

Online methods enable you to to prepare your doc administration and improve the efficiency of your workflow. Adhere to the fast guide to be able to complete Form 886-H-ITIN (Rev 6-2017) - Internal Revenue Service, refrain from mistakes and furnish it in the timely fashion:

How to complete a Form 886-H-ITIN (Rev 6-2017) - Internal Revenue Service on the web:

- On the web site with all the type, simply click Begin Now and pass with the editor.

- Use the clues to fill out the suitable fields.

- Include your individual data and contact facts.

- Make convinced that you just enter correct data and figures in ideal fields.

- Carefully check the articles belonging to the sort at the same time as grammar and spelling.

- Refer to help you segment should you have any thoughts or tackle our Assist group.

- Put an electronic signature on the Form 886-H-ITIN (Rev 6-2017) - Internal Revenue Service using the assistance of Indicator Resource.

- Once the form is concluded, push Completed.

- Distribute the prepared variety by means of electronic mail or fax, print it out or save on the system.

PDF editor permits you to definitely make variations for your Form 886-H-ITIN (Rev 6-2017) - Internal Revenue Service from any world-wide-web related unit, customise it as reported by your requirements, sign it electronically and distribute in different approaches.