Hi, my name is Cory. Welcome to my blog, accessibleexpert.com. I am an expert in internet marketing services and I'm here to show you how to make more money online and get to the top of search results. I learned a lot in 1999 when I started batteriesforless.com, a very competitive market. I quickly realized that the key to success was achieving top search rankings for competitive keywords. We worked hard and achieved number one positions for keywords like phone batteries and cell phone batteries, along with hundreds of others. With those top rankings, Batteries For Less became a multi-million dollar online success. On this blog, I will show you exactly how we do it. I want to simplify the complicated world of internet marketing and provide you with a step-by-step approach to practical, fundamental search marketing and search engine optimization. I will also teach you how to build important backlinks and effectively use social media marketing to get noticed. In addition to my own expertise, I have brought in experts from various fields, including social marketing, ecommerce website design, email marketing, and SEO. Together, we will help you save time, save money, and ultimately make more money through your website. Feel free to read the articles, watch the videos, and participate in the discussion. Leave a comment, ask a question, and learn from the experts about what it takes to become a successful online business. Join me on this journey to online success.

Award-winning PDF software

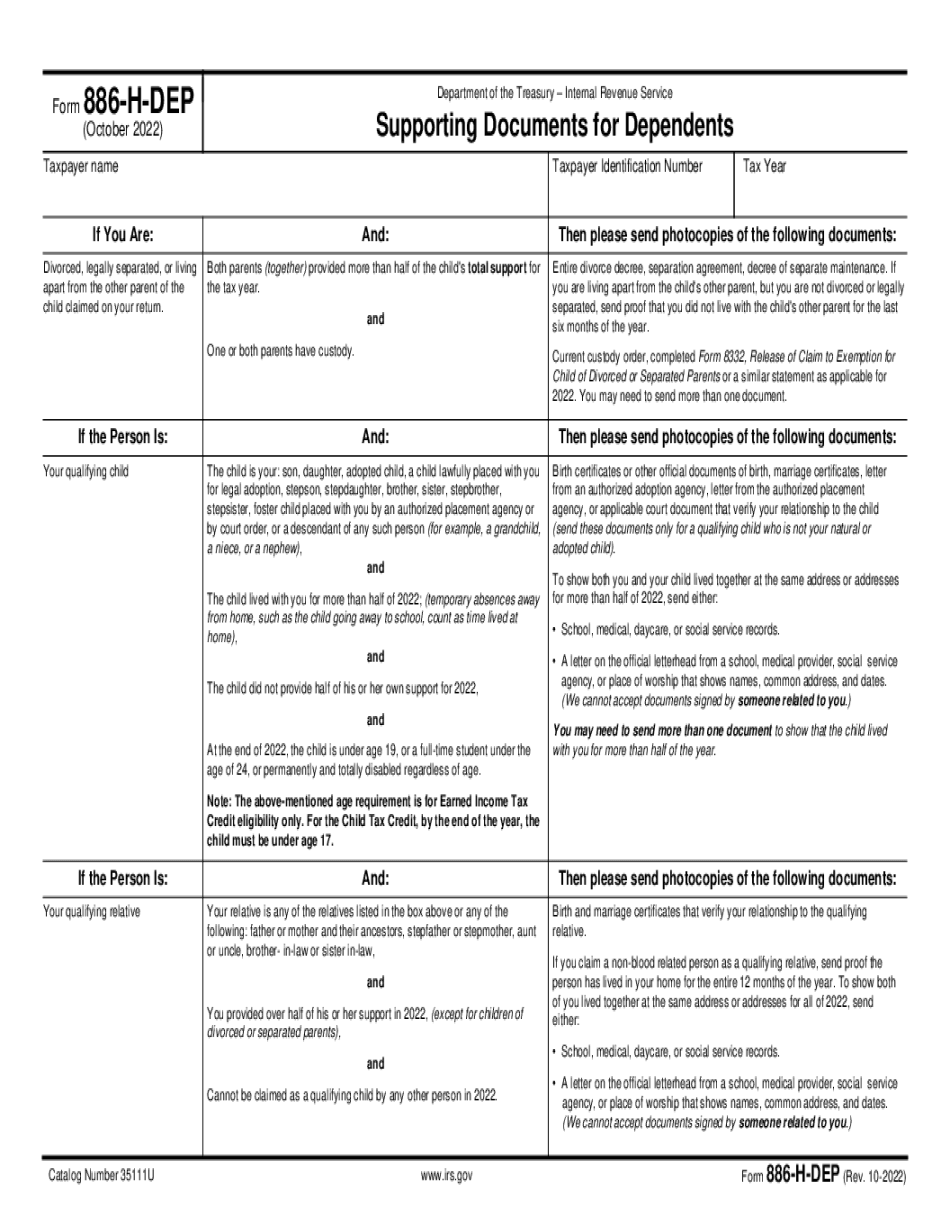

886-h-dep Form: What You Should Know

Filled. 2025 886-H-DEP Form 2025 Fill now. 886 h DEP. Form 886-H-DEP Rev. 1-2019. Filled. 2 886-H-DEP Fill Online, Fill at a Retail Office Fill the 2025 tax form now and send it to the post office now. Use the IRS 886 H-DEP Fill Online tool now to get a complete 2025 federal, state-federal, and local tax return ready to mail to IRS. IRS 886-H-DEP. Fill now. 2025 886 h DEP. Fill now. 886 h DEP. Form 886-H-DEP 2019. Filed. 2103-4 886 h DEP. Fill now. 2025 ETC on IRS.gov. Fill the 2025 886-H-DEP Fill Online, fill at a Retail Office or by mail. Get ready for this year's Tax Season quickly and safely with a complete, easy to fill 2025 federal tax return ready to mail to IRS. IRS 864-H-DEP Filing and Paying Now. Fill out the 2025 864-H-DEP Form 864-EITC and use it with mail to send a 2025 Federal Form 865-EITC-Related Form 885-EITC (for children) or a Federal Form 885-EITC-Related Form 886-EITC (for people with disabilities) or 2018 Tax Forms Form 864-EITC. Use it with mail and file 2025 tax forms electronically: 2025 864-EITC Form Fill Out, Pay and File. 2025 864-EITC Form Fill Out, Pay and File. 2025 865-EITC Fill Out and Send to IRS.gov, Pay and File, Fill at a Retail Office or in Person. Fill out the 2025 864-H-DEP Form 864-EITC and use it with mail to send a 2025 Federal Form 865-EITC-Related Form 885-EITC (for children) or a Federal Form 885-EITC-Related Form 886-EITC (for people with disabilities) or 2018 Tax Forms Form 864-EITC. File 2025 tax forms electronically. 2025 864-EITC Fill Out, Pay and File.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 886-H-DEP, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 886-H-DEP online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 886-H-DEP by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 886-H-DEP from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 886-h-dep