Hey everybody Joe Parker with the Santa Barbara group at Berkshire Hathaway real estate I'm doing a couple videos for you a two-part series on sellers disclosures California real estate is all about disclosures that's the big thing that can get you in trouble as a seller if you don't properly disclose everything you know about the home well beyond the time that it closes escrow you could have those issues come back and and haunt you in the form of a disgruntled buyer who felt like they were misled or misrepresented somehow in the fact that there's a defect in the home they thought they should have known about and then next thing you know you find yourself in a lawsuit so one of the biggest roles of a real estate agent is to help a seller navigate all the difference disclosures that are required by law for them to fill out and then also navigate the ones that are not required by law but will help them in protecting them with full disclosure about the property so two-part series I'm gonna go over the real estate transfer disclosure statement in this video and my next video will be on the sellers property questionnaire between these two forums you could pretty much communicate everything that you know to be going on with your property to your buyer and so starting with the real estate transfer disclosure statement in the industry we call it the TDS short for a transfer disclosure statement it's a three-page form this is what it looks like I pulled one from a file I'm currently working on I sold a house to some buyers of mine in Goleta and this is directly from that file so what happens with the TDS is the seller will...

Award-winning PDF software

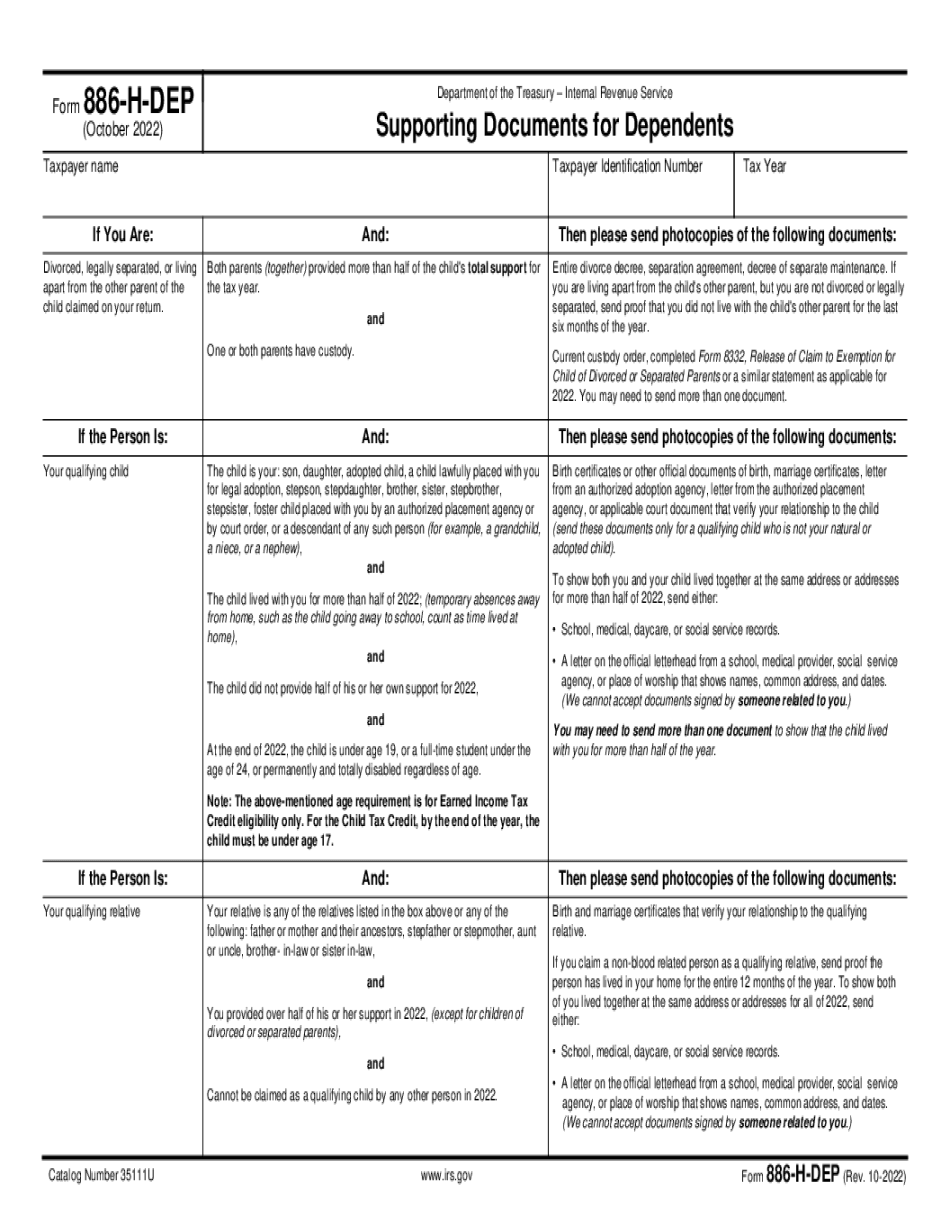

886-h-int Form: What You Should Know

This is Form 886-H, and it can be used to file the American Opportunity Credit with your original Forms 1040, 1040A, 1040EZ, 1040A2, 1040EZ-EZ and 1040A IRS Form. Form 886-H-S (2) to obtain additional copies of Form 886-S—H if the last 7 years of foreign income is 1,000,000 or more (Form 886-S-T-H.) October 7, 2025 — Form 886-H-S (2). This is Form 886-H, and it can be used for all children who have earned 1,000,000 or more in a calendar year. A child who has earned more than 1,000,000 in a calendar year must use a Form 1040, Form 1040A, Form 1040EZ or Form 1040A2 to file. Oct 14, 2025 — Form 886-H and this is the link to Form 1040, 1040A, and 1040EZ (1040-A2) to request electronic filing with Form 1040EZ (1040). Form 886-H, (2) American Opportunity Tax Credit (Form 886-H-AOC). This is the form to file for Form 886-S—H. If you're a dual filer, and you've received a 1040A from April 2014, and a 1040EZ from March 2016, these forms are available in your original 1040A form if you need them for you to file a Form 886-H. This form is also used for the American Opportunity Tax Credit (Form 886-S—S). It is in the following PDF file (with your original 1040-EZ form, but with the “AOC” and “S-T” pages reversed). Oct 27, 2025 — Form 1040T (Individual Income Tax Return) with Form 941, 1040A, 1040EZ or 1040A2 (with a link to Form 4641-EZ, Individual Income Tax Return). If you can't use any of the following three forms without a 1040A or 1040EZ you can obtain one of these forms on IRS.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 886-H-DEP, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 886-H-DEP online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 886-H-DEP by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 886-H-DEP from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 886-h-int