Law.com's legal forms guide, form 355-S, is used by S corporations operating in Massachusetts to calculate their excise tax owed to the state. - You can find the form on the website maintained by the state's Department of Revenue. - Step one, located at the top of the first page, requires entering the beginning and ending dates of your filing period. If you are not filing on a calendar year basis, proceed to step 2. - Step two requests information such as your corporation's name, federal employer identification number, and principal business address. If the principal business address is different from the address in Massachusetts, provide that as well. - Step three instructs you to answer all questions on the first page. - Skip to the third page and complete the balance sheet under Schedule A (found there). - Proceed to step five and complete the tangible and intangible property worksheet under Schedule B. If line 15 of Schedule B is ten percent or more, complete Schedule C and transfer line four's result to line one on the second page. If line 15 is less than ten percent, complete Schedule D and transfer the result on line 10 to line two on the second page. - Move on to step six and complete Schedule E-1 to determine your dividends deduction. Complete Schedule E to determine your state taxable income and transfer the result from line 27 to line five on page two. Before returning to the second page, complete Schedules C, D, CR, and RF. Transfer the total credits from line 15 of Schedule C to line ten on the second page. Transfer line six of schedule RF to line 21 on the second page. - Step seven focuses on the second page. Complete the calculations on lines one through three as instructed to determine your income. -...

Award-winning PDF software

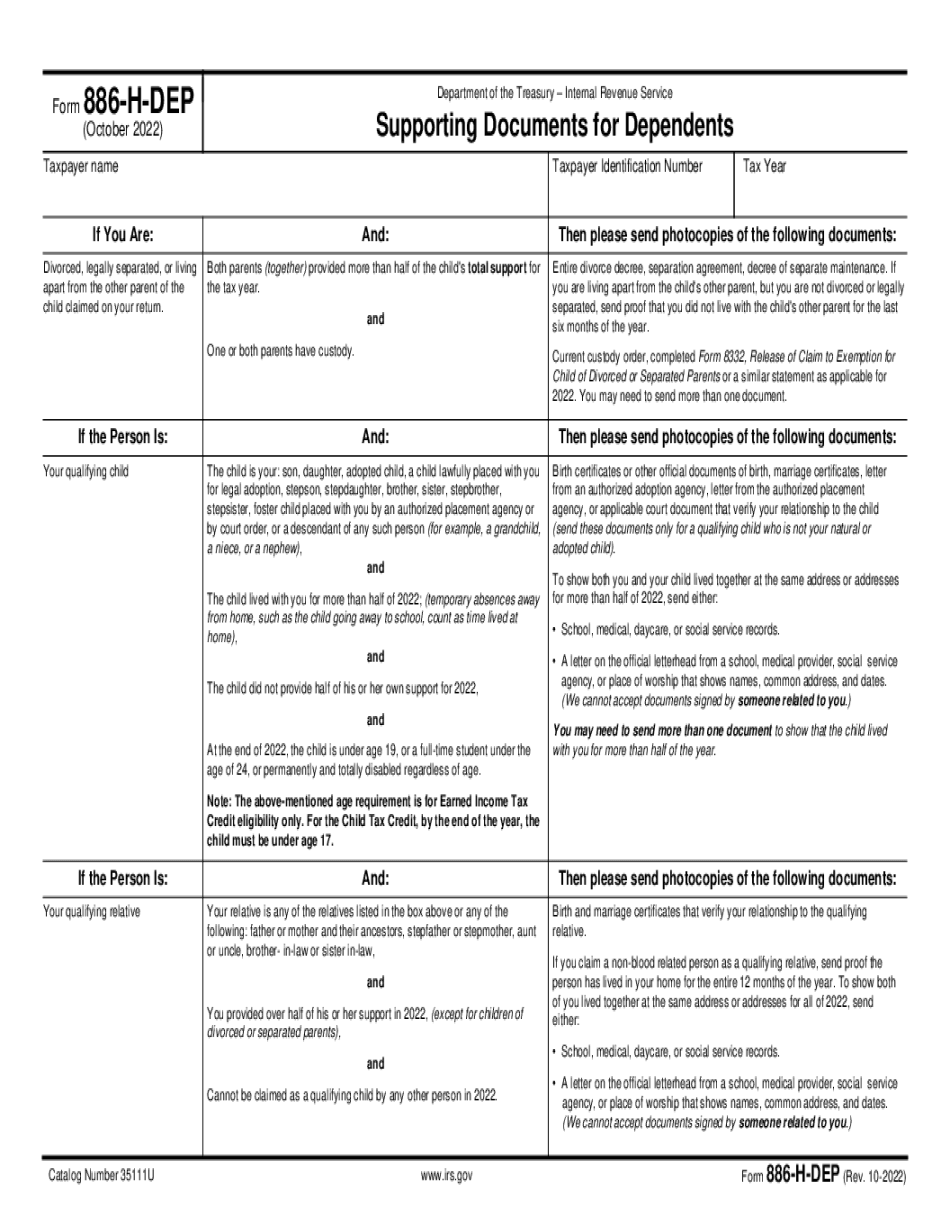

886-H-DEP Form: What You Should Know

S. (No need to change visa serial number or visa expiration date, though it's a good idea) Please note: the information in the form will be different and is separate from Form DS-260 and the DS-160. If you have any questions or problems with the form, you also may email the US Embassy or Consulate, or call ((, if you do not speak English well) and we will help you resolve any difficulties you have. You are authorized to file your DS-260 form by the applicant's country of birth. (For most countries, this is the actual birth country of an individual.) If the country of legal residence for your present employment is different from the country of birth, file a DS-260 for the country of legal residence, with your original DS-160 form, when filing Form DS-260. The US Embassy or Consulate can help you with obtaining documentation you will need in order to submit your DS-260 application. Please visit the website of each Embassy or Consulate listed below for assistance.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 886-H-DEP, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 886-H-DEP online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 886-H-DEP by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 886-H-DEP from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 886-H-DEP